China stainless steel production growth to slow in 2020

31 Aug-2018

China stainless steel production growth to slow in 2020

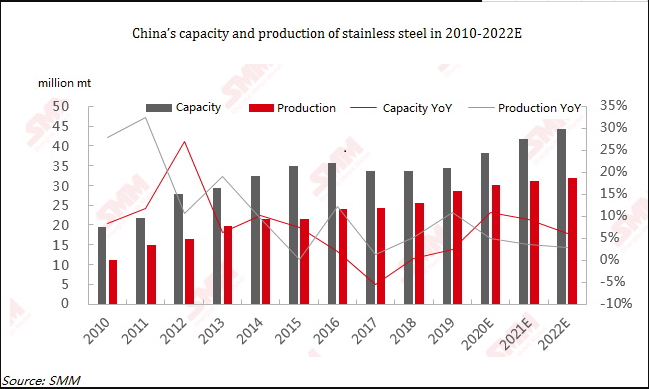

China’s production of stainless steel is expected to rise 5% in 2020, slowing from an 11% increase amid concentrated release of production capacity this year.

SMM also estimates a compound annual growth rate (CAGR) of 2% for domestic stainless steel production in the next three years.

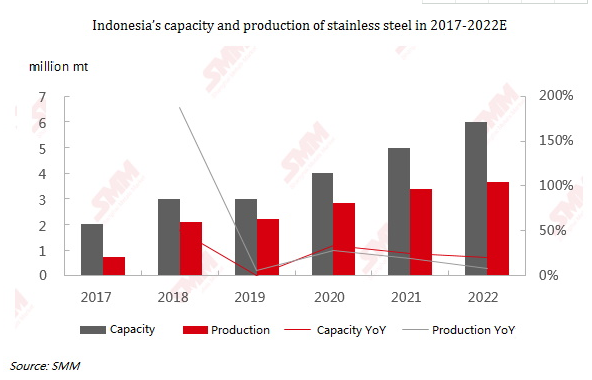

In Indonesia, the increase in stainless steel capacity is forecasted at around 33% in 2019-2020, contributed by Delong’s Indonesian projects.

Indonesia’s abundant resources of lateritic nickel ore, which provides the key ingredient in stainless steel, have prompted foreign investors to build smelters and stainless steel plants in the country. But its capacity utilisation rate for stainless steel will be capped given top consumer China’s anti-dumping duties on stainless steel products from Indonesia.

China’s stainless steel prices took a roller-coaster ride in 2019, boosted by soared prices of raw material nickel after Indonesia brought forward a ban on ore exports by two years.

The price range of spot 304 cold-rolled stainless steel, for instance, climbed to 14,000-16,000 yuan/mt in the second half of this year, from 14,000-15,000 yuan/mt in the first half of the year. Near-term prices will move in line with costs, SMM expects.

The raw material nickel input for stainless steel primarily comes from ferronickel (with a grade above 15%), nickel pig iron (NPI), refined nickel, intermediate nickel products, and scrap stainless steel.

Supply of ferronickel in China will be affected by Indonesia’s ore export ban from 2020, but rising NPI capacity and higher grade in Indonesia will help to plug some supply shortfall.

SMM estimates the proportion of NPI in the feedstock mix for stainless steel close to 60% in 2020, with that of refined nickel around 8%. The share of stainless steel scrap used as raw materials will likely exceed 20% with the standardisation of the recycling system in China.

On the downstream front, petrochemical and equipment sectors will remain the key driving force behind stainless steel consumption.

Demand from traditional sectors of catering appliance, building decoration, and home appliance will stabilise in the upcoming three years, while highlights in growth are seen from the emerging markets of stainless steel water pipe and stainless steel roof, SMM believes.

Source: SMM

COMPANY NEWS

COMPANY NEWS

INDUSTRY NEWS

INDUSTRY NEWS

LIST OF CLIENTS

LIST OF CLIENTS

- RELATED NEWS

- The future development trend of China's stainless steel pipe

- Stainless steel inventory statistics (2021.3.5--2021.3.11)

- Stainless steel alloy surcharge rises for 4 months

- China’s stainless steel prices rebound

- LME nickel price sharply rebounds on Mar 31

- Chinese stainless steel prices slump despite recovering domestic demand